@Zhun Lun Law Firm

AustCham Reception Desk

△Di Hu

To kick off the seminar, Di HU, Events and Communications Manager at AustCham South China, expressed her warm welcome to the audience.

△Geoff

Geoff started by stating that this is the first business seminar of AustCham South China’s new series of seminars focused on legal and regulatory issues as well as practical business feedback and experience sharing.

He then briefly touched on some foreign investment facts related to the China-Australia relationship. For example, he mentioned that according to the Australian Bureau of Statistics, the stock of total Australian investment in China reached AUD77.1 billion in 2017, of which direct investment made up AUD13.5 billion; while the stock of total Chinese investment in Australia was approximately AUD65 billion in 2017, of which AUD40.7 billion was direct investment.

Furthermore, Geoff emphasised that like our bilateral trade relationship, the two-way investment relationship is complementary and benefits both countries. The Consulate looks forward to working with Australian businesses to understand the way the new Foreign Investment Law will be implemented on the ground in China.

Following his opening remarks, Geoff handed the floor to the first speaker, Kent Woo from Zhong Lun.

△Kent Woo

Regarding the impact of the Foreign Investment Law on the corporate governance of joint-ventures, here are somr takeaways.

△Thomas Wong

△Hailey Guo

Case Analysis

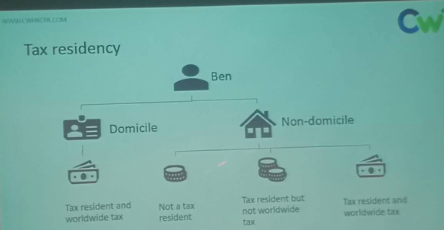

For example, if Ben attained a permanent Chinese residence card, bought an apartment in China and lived there with his wife and children, it would be very likely that he would be treated as having a domicile in China and thus subject to worldwide tax. Moreover, individuals who do not have a domicile in China but have resided in China for 183 days or more accumulatively within a tax year shall be deemed as resident individuals. Many participants were interested in this topic as it helped them understand how to avoid becoming a taxpayer on their worldwide income. Also, Hailey remarked about the updated preferential policies and made a comparison between specific additional deductions newly introduced by the revised Individual Income Tax Law, as well as eight tax exemption allowances. Finally, Hailey shared what employers and employees should do under the amended IIT Law.

• Offer training and guidance

2. Establish policies and procedures

• Collect information in time

• Enhance internal control and mitigate the compliance risk

• Keep relevant tax documents for audit purpose and to avoid disputes

3. Special arrangement for expatriate employees

• Tax break arrangement for expatriate employees

For employees:

1. Keep supporting documents

• Deduction items for 5 years

• Arrange tax break

2. Review tax status and compliance

• Review global investment portfolio

• Identify China-sourced income

3. Review tax filing compliance

• Reasonable amount and scope of allowances

From left to right: Geoff, Matt, Kent Woo, Halley Guo, Spring

Matthew stated that Chinese domain name registration, like trademark and patent registration, uses a “first-to-file” system, meaning that whoever files for the domain name first (with very few exceptions) owns it. He explained that it is not uncommon for foreign companies establishing their business in China to discover that [.cn] Chinese domain names identical or similar to their trade name or mark and their [.com] domain name have been registered by others – who often have a bad faith intent to profit from the company’s trademark by demanding high sums of money in return for transferring ownership of the domain name (known as “cyber-squatting”).

Companies can challenge this under certain conditions and make a submission for arbitration, Matthew said, but this must be done within two years of the domain name’s registration, otherwise litigation becomes the only option to legally contest ownership, meaning more effort and cost.

Catering